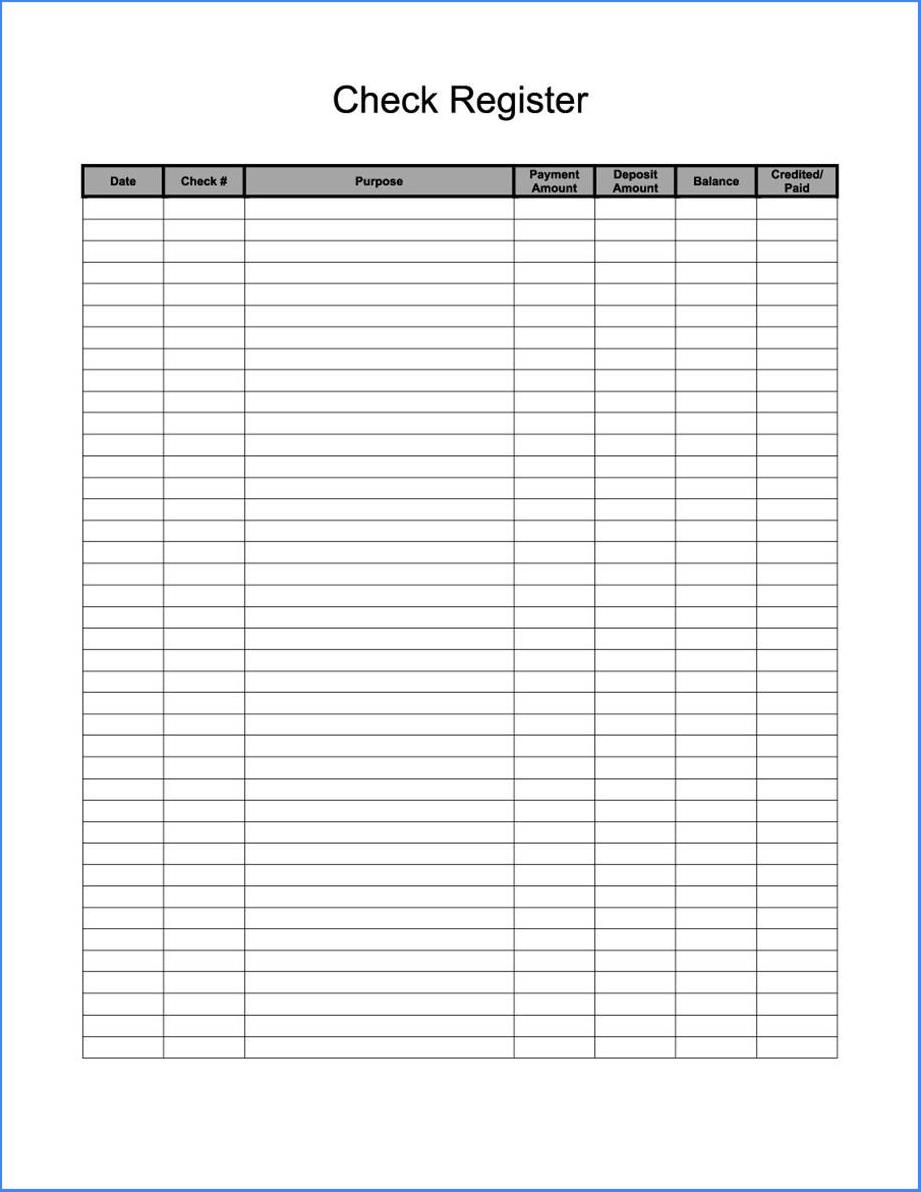

But, since you’ve authorized the purchase, you must not consider it available money. This is equivalent to an uncleared check and has not yet been deducted from your account. When looking at your online checkbook register, you might see a transaction in a “Pending” state. Since most of today’s transactions happen with some form of digital transaction, this process is immediate in most purchases. With a physical check, this process can take several days and is dependent on when the payee deposits the check. Notice that column G is titled “C.” That stands for “Cleared.” When a check has been processed through the bank and the funds distributed to the payee, then the check is considered “cleared” through the bank. The last worksheet feature I’d like to point out is the clear check option. (See the Checkbook Register Overview image for a graphic view.) The beauty of this digital register is that the “Balance” column keeps a running tally of your checkbook. Debits and Credits are individual columns. The “Type” and “Category” columns offer customizable drop-down menus for easy data entry and detailed record keeping. It has name, period, beginning balance, statement balance, and checkbook-balance fields. The main worksheet appears like a basic checking account statement you would receive from your bank. Let’s take a quick look at this Checkbook Register spreadsheet to see if it’s a template you would like to use to help balance your checkbook. Keeping track of income and expenses with a transaction register is a great way to record the comings-and-goings of your money. Maintaining a checkbook register will help you get on top of the error fast, get back on track, and hopefully prevent any overdrawn checks.īudgeting requires an accurate picture of your spending. (And, as this NBC article suggests, if the error is in your favor, don’t keep the cash).

But, have you heard of a “bank error.” Yes, human error is possible in banking.

Banks operate financial systems that manage millions of transactions and they are governed by strict regulations. I’d like to focus on two of those reasons: Accountability and Budgeting.Īccountability ( refers to this as “Control”) means knowing that all your money is being accounted for correctly.

The popular personal finance website,, gives four reasons to keep a physical check book register.

PRINTABLE CHECKBOOK REGISTER DOWNLOAD

So, why download a personal checkbook register template? Even though the check book might be vanishing, we still need to track the money that enters and leaves our accounts. Services such as automatic bill pay, online bank transfers, credit cards, debit cards, and instant payment methods (requiring only your cell phone) have almost replaced the need for checks. As easy as this is, I’m sure there are plenty of checking account owners today that have never “written” a check. And if I don’t want to take the time to go to the bank, a quick online search of “check template” results in several sites that offer a blank check template or software. Either as a cashier’s check (at a cost) or as a blank check with the bank’s information, my account number, and any check number I would like printed on it. In the rare case that I do need a physical check (twice in the last two years), my bank is more than willing to print one. Like most people I know, I don’t even own any physical checks for my “checking” accounts. The days of writing checks are gone – or at least going fast.

0 kommentar(er)

0 kommentar(er)